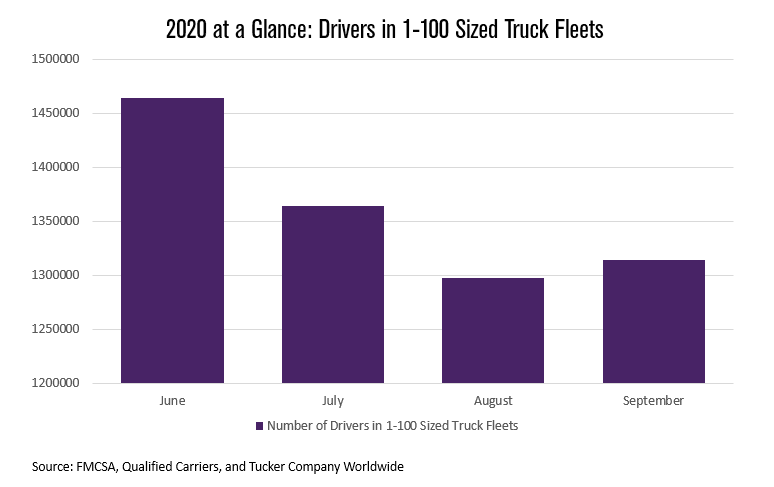

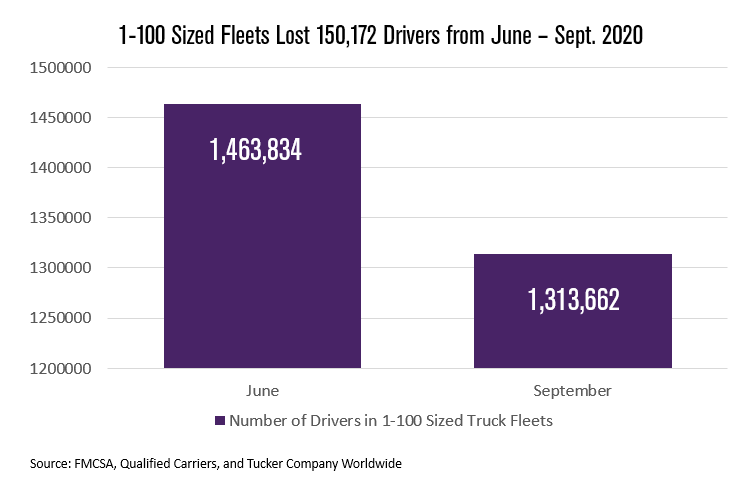

An analysis of data provided by the Federal Motor Carrier Safety Administration (FMCSA) and Qualified Carriers shows a decrease of 150,172 drivers from June 2020 to September 2020. That’s a 10.3% reduction in drivers at 1-100 truck fleets — a category that represents nearly half of all drivers on the road today. (There are 1,623,426 drivers remaining in fleets with more than 100 trucks.)

This is the largest downturn we have seen since we began analyzing this data in 2012. While it’s difficult to pinpoint the exact moment in time when these drivers threw in the towel (there tends to be a lag due to the self-reporting nature of driver data), it is evident that this is an unfortunate consequence of the events of 2020. The driver decline seems to coincide with the timeframe where unemployment subsidies ran out, so that may have played a factor, but the elephant in the room is that many owner-operators continue to operate without a solid customer base.

According to Truckstop.com, the majority of truckers using their product are looking for their next haul vs. a backhaul, meaning they are products of the spot market. Over one hundred years of their predecessors started businesses with at least one primary shipper customer. Starting a trucking company without a customer, and depending solely on the spot market and brokers as your primary or exclusive customer, is perhaps the riskiest business proposition in logistics. When things turn downward, there’s no safety net — no stability. We have been warning drivers about this for years, via radio, writings, and media conversations.

Unfortunately, as we reflect on April and May of this year, as the pandemic shut down much of the economy, we saw the negative consequences of these highly leveraged drivers. In April, data shows that nearly 25% of all U.S. truckload shipments disappeared and load tender acceptance rates (the percent of first-time shipment offers from shipper TMS’s to their primary carriers/brokers on a particular lane) were at nearly 100%. That meant the second or third provider on the shipper’s list never got a call, and therefore very few loads ever entered the spot market. So, if you’re an owner-operator without shipper customers, depending solely on the spot market, maybe 75-90% of your shipments disappeared. Against this backdrop, it is no wonder that many drivers exited the business, at least temporarily.

It’s important that shippers remain aware of this shift in the makeup of the freight transportation marketplace — especially as they decide how they’ll spread their volume in both good times and bad. When shippers give asset-based providers all of their volume, they’re inherently prioritizing the larger fleets and, hence, deprioritizing owner-operators. (It’s important to note that the average-sized fleet in the 1-100 category is only about 6 trucks, meaning there are significantly more owner-operators in this group than one might think.) When 4.7% of all capacity is lost, you’ll see escalating prices thanks to a driver shortage.

A healthy freight transportation marketplace is a balancing act: shippers need to be nimble, flexible, and insist that their procurement teams prioritize scalability by incorporating a healthy mix of reliable brokers into their awards. This will save them from overpaying when the spot market skyrockets and many of their larger carriers leave for greener pastures, which always happens in upturns.

Carriers simply must recognize the importance of having at least some core shipper customers who depend on their service and try to use load boards as more of a backhaul. They were never meant to be used exclusively to operate your business. When you ride a wave, as many carriers have recently, you must be prepared to crash ashore. Build that shipper customer base. Don’t operate solely off the spot market.

Until shippers and carriers change their operating behaviors, we’ll keep seeing capacity crises and market volatility, as we’ve experienced for the past six years, and shippers will need to be able to quickly adapt.

Need help navigating a capacity crisis? Contact us today!