There’s a false narrative being shared that the trucking industry is contracting and there is a driver shortage. For that, we can thank partial research data that’s shared with investors, analysts, reporters, and economists that leaves out some pretty compelling economic movements afoot in trucking.

For the past eight years — since February 2012 — we have been analyzing data provided by the Federal Motor Carrier Safety Administration (FMCSA) and Qualified Carriers to garner industry trends and stay ahead of the curve for our customers. It is through careful analysis, that we can say with conviction that the narrative being shared today is not indicative of the trucking industry.

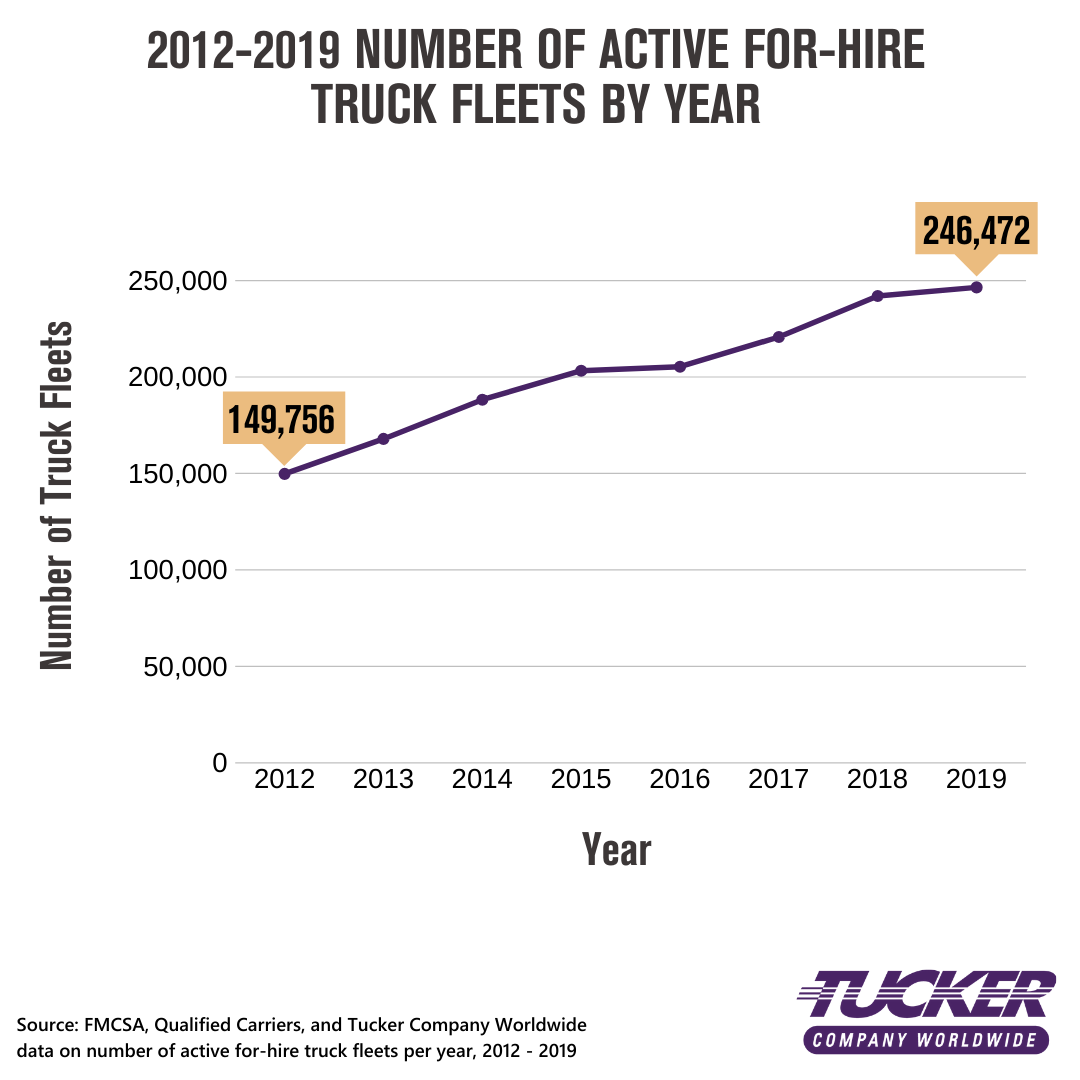

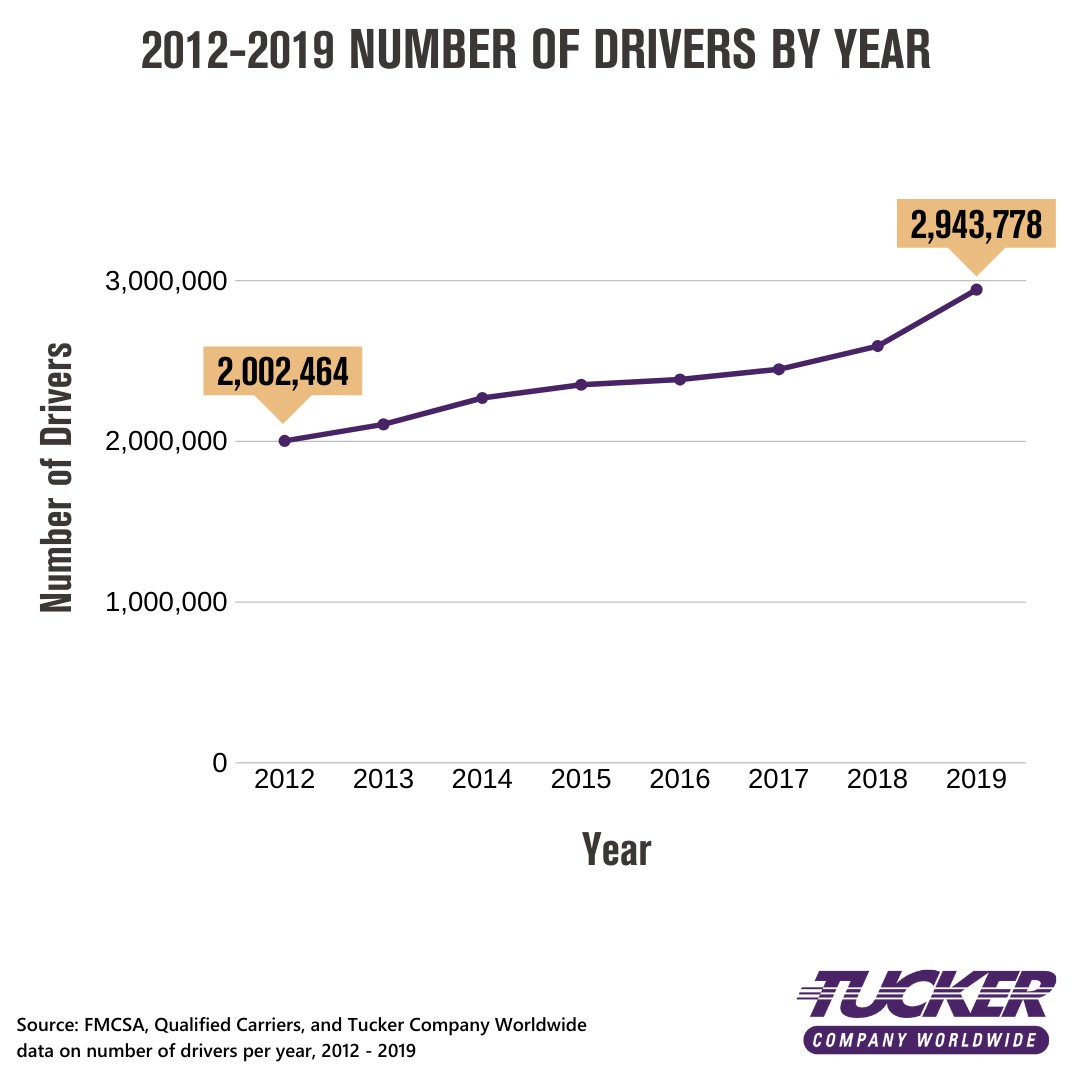

The industry is not contracting and there is not a driver shortage. In fact, the number of active for-hire trucking companies and the total number of drivers have been growing steadily, and at the end of 2019 both groupings exceeded those of December 2018.

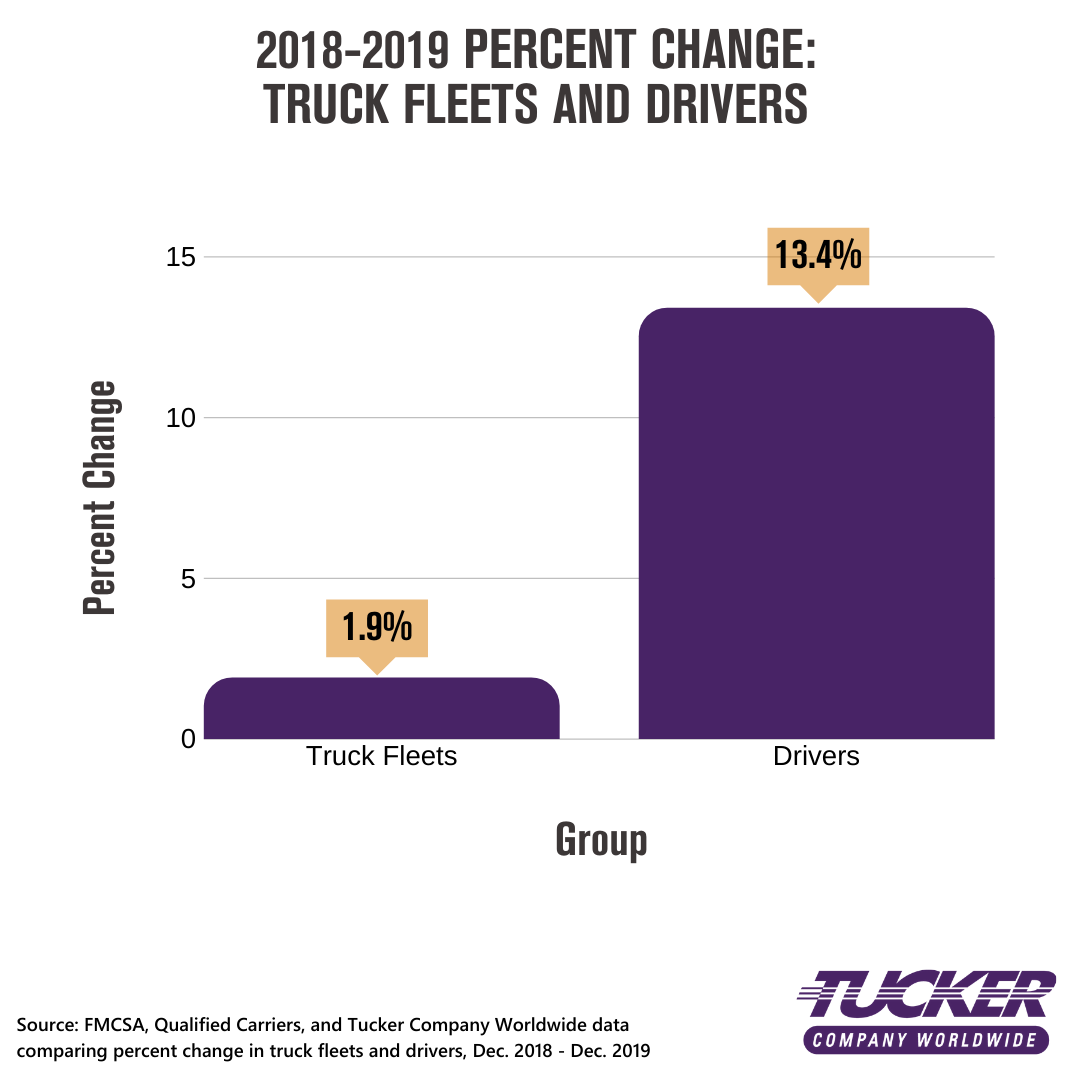

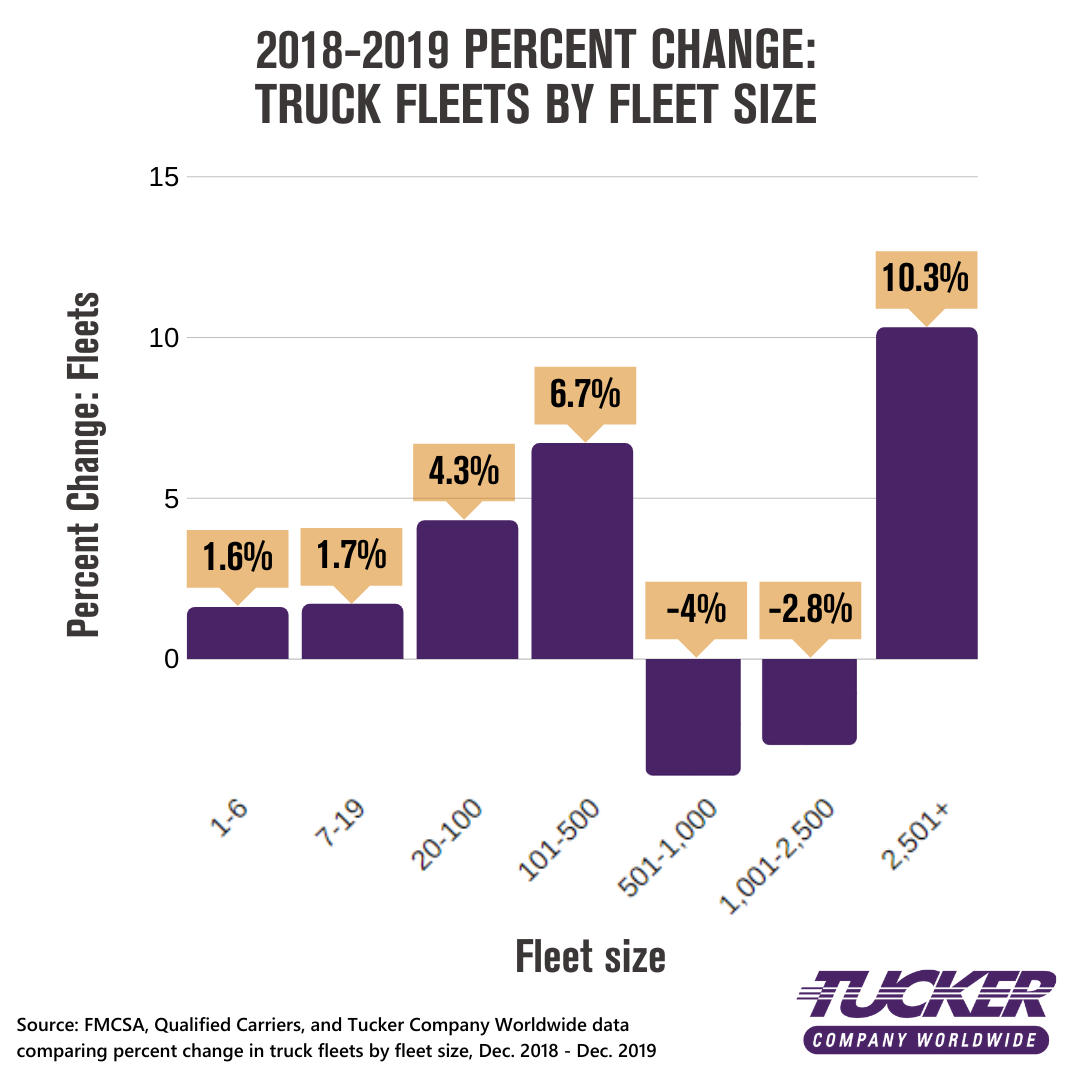

Overall, Truck Fleets grew by 1.9%

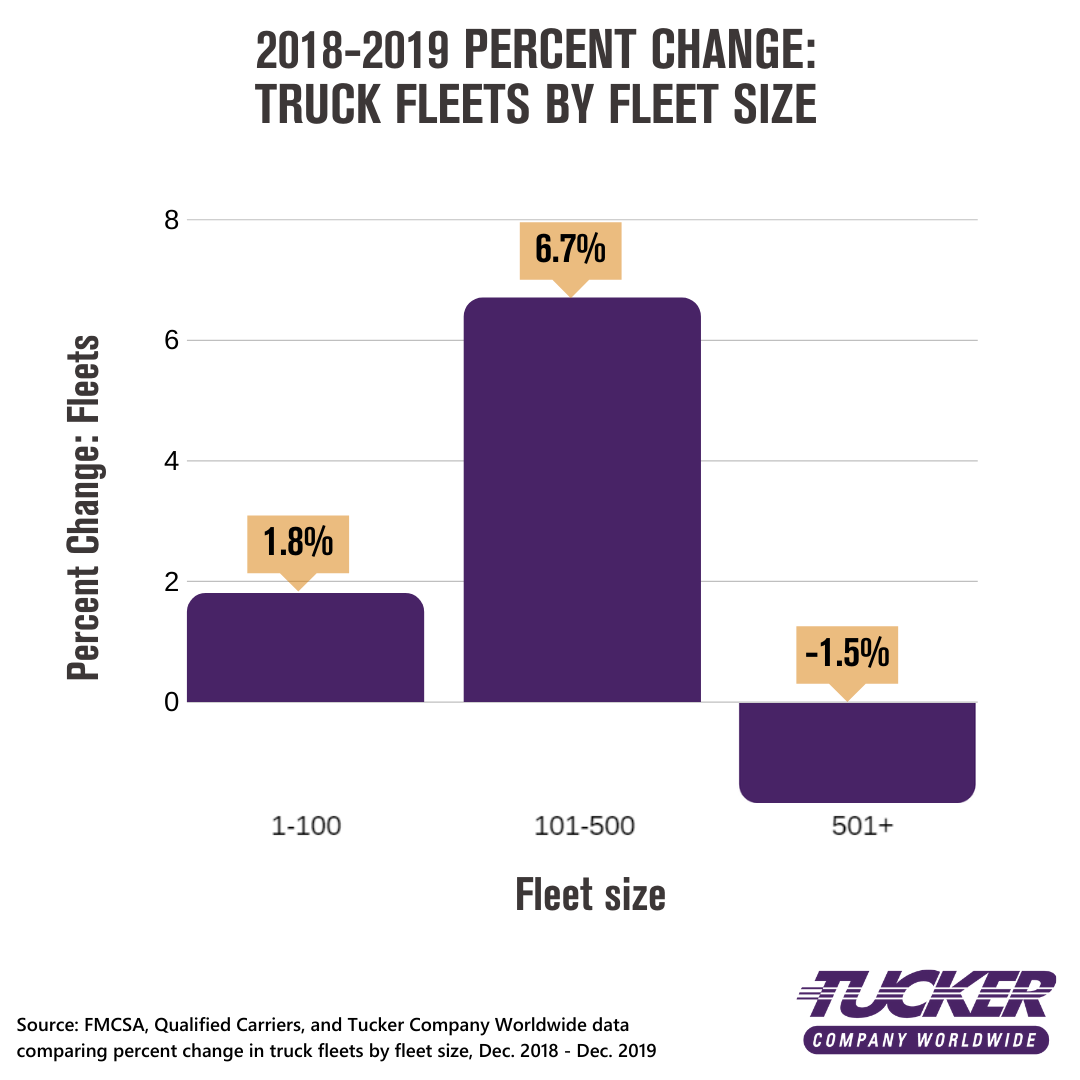

Year over year, we saw an additional 4,479 trucking companies, adding 1.9% overall and bringing the total number of active for-hire trucking companies to 246,472. But, fleets operating 501+ trucks saw a loss of 6 trucking companies, dropping from 390 to 384, for a loss of 1.5%.

There is not a Driver Shortage

In addition to an increase in the number of fleets on the road, year over year, more than 354,000 drivers were added to the nation’s total truck driving population — bringing the total number of drivers who were driving for active for-hire carriers to 2,943,778 as of December 2019. That’s a 13.4% increase in the total number of American drivers.

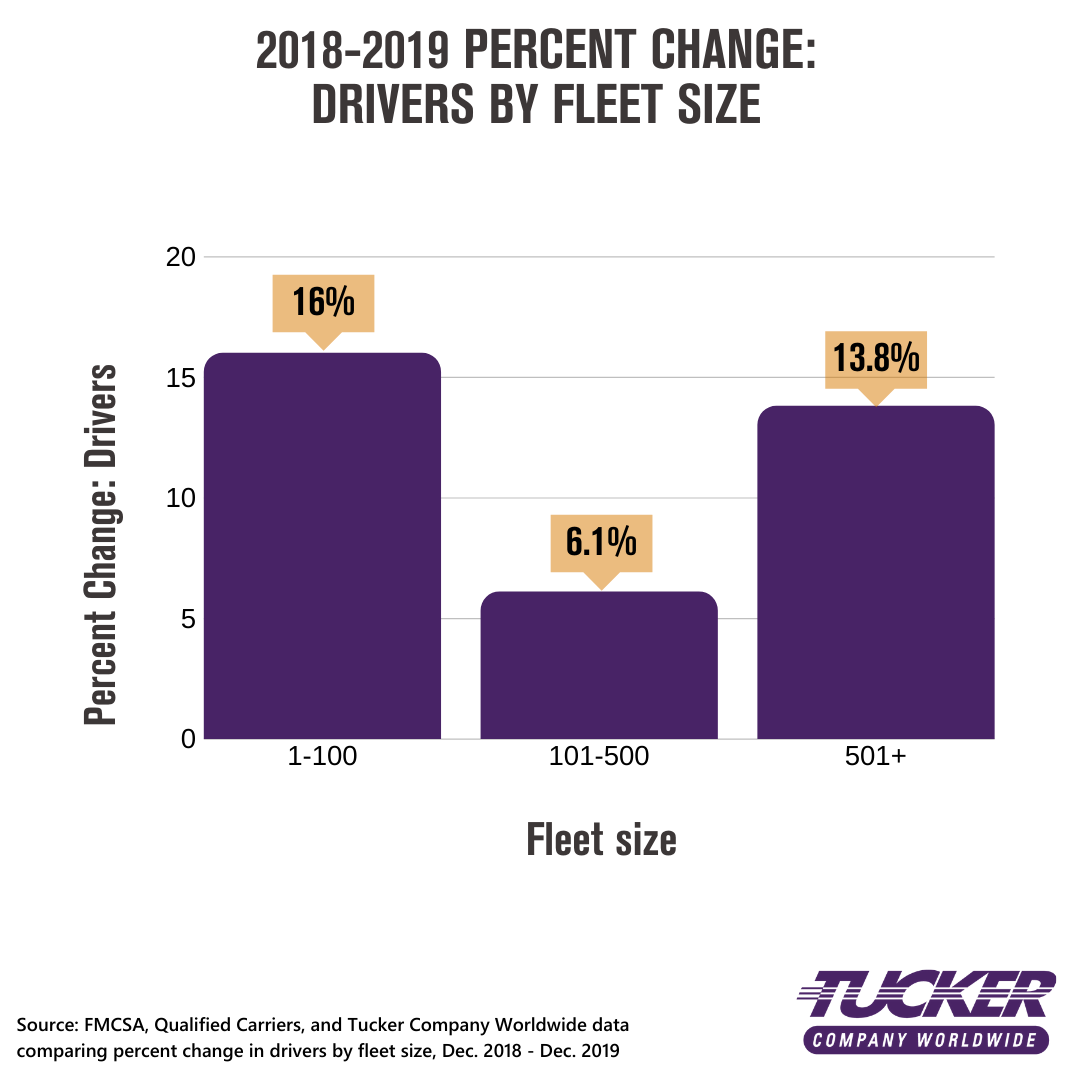

Interestingly, the largest fleets (501+ trucks per company) — which lost 1.5% of their capacity — added a whopping 133,705 net drivers to their fleets, bringing them to 1,100,757 drivers. Not to be outdone, small fleets (1-100 trucks per company) added even more — netting 191,524 drivers, bringing their total to 1,390,390 and bringing them up to 26% more capacity than the largest fleets. The smallest fleets continue to outpace their larger siblings, both in driver growth and total driver count.

Something Interesting is Happening with the Largest Carriers

As mentioned above, fleets operating 501+ trucks, saw a loss of 6 trucking companies, dropping from 390 to 384, for a loss of 1.5%. Yet, they still added 133,705 net drivers to their fleets, bringing their total drivers to 1,100,757, for a 13.8% increase. A close inspection of this data shows something even more interesting.

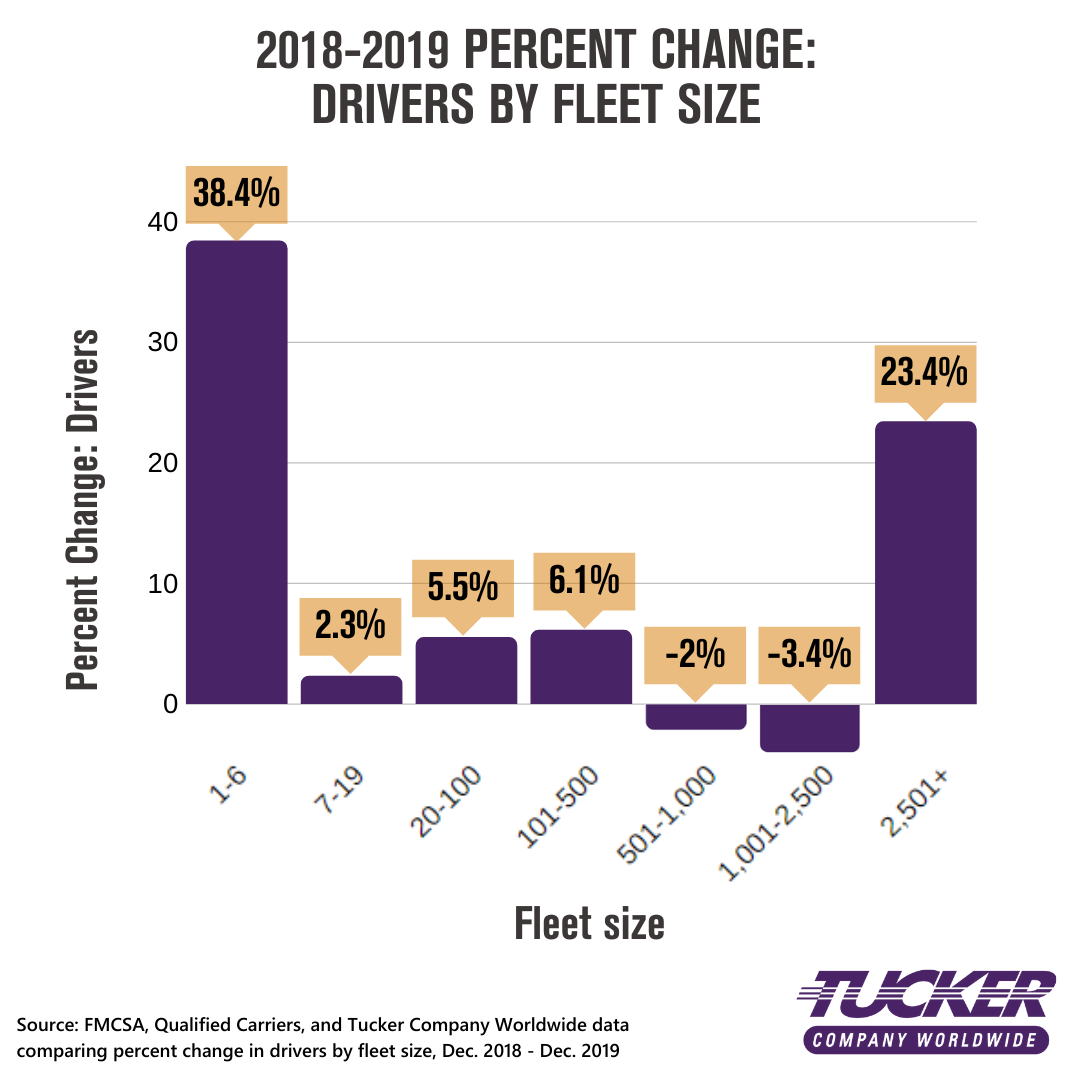

Fleets with 501-1,000 trucks declined by 9 carriers, from 226 to 217, and lost 3,417 drivers, or a 2% decrease. The next group, 1,001-2,500 trucks declined by 3 carriers, from 106 to 103, and lost 6,357 drivers, for a 3.4% decrease. The winner? The biggest fleets, or those with 2,501+ trucks. They saw their population grow from 58 to 64 carriers, for a 10.3% increase, and driver count soared by 143,479 to 756,129, for a 23.4% increase. The big are getting bigger. And if rates stay low, and demand for trucking doesn’t rise, the biggest carriers may get even bigger, as independent drivers seek some shelter.

But the 143,479 growth that the largest carriers saw is still smaller than the net number of drivers that the 1-6 truck fleets added in the same period — 156,813. So, you can also say the small are also getting bigger.

In short, the trucking industry grew from December 2018-2019, contrary to what you may be hearing. We’ve got the data to prove it.